What are Medigap Plans?

September 19, 2023 at 9:00 PM

by Tara Taws Claghorn-Nicastro

Rittenhouse Square Insurance

Rittenhouse Square Insurance

Medigap or Medicare Supplement Plan Basics

- Fill the “gaps” that Original Medicare A&B don’t cover

- Can help pay for copays/coinsurance/deductibles of Medicare A & B

- Sold by private insurance companies

- Medicare Supplement Plans are differentiated by letters ( Plan A - Plan N)

- Plans A - N cover different parts of the Medicare A & B deductibles, coinsurance, and copays

- Plans A - N are priced differently

- Standardized = offer same basic benefits regardless of insurance company

- Must follow all federal & state laws to protect you (i.e. be clearly identified, etc.)

- For example, all Medicare Supplement plan Gs have to cover the same basic benefits regardless of the insurance company selling it - what varies is the PREMIUM (price)

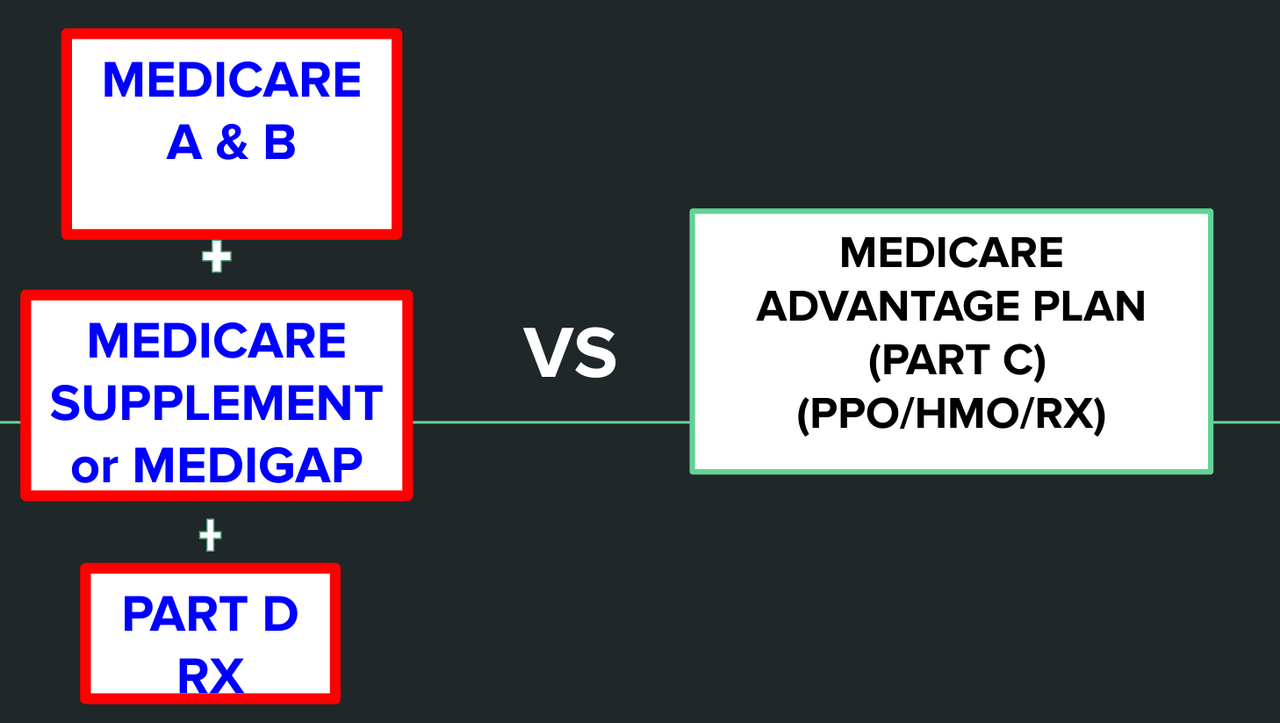

How are Medigap Plans Different from Medicare Advantage Plans?

- Medicare Advantage Plans = another way to manage/get your Original Medicare A & B benefits

- Medicare Advantage PPOs/HMOs manage your Medicare Part A, B and D benefits for you

- The PPO/HMO process your medical claims

- Medigap Plans only help pay for costs that Original Medicare A & B don’t cover

- Medigap plans are secondary insurance to your Original Medicare A & B

- CMS (Medicare) processes your medical claim first, then your Medigap is a secondary insurance and covers some or all of what Medicare A & B don’t cover (depending on Medigap Plan choice/benefit outline)

- Can’t have a Medicare Advantage plan AND a Medigap Plan

- Medigap plans don’t have networks, if provider accepts Medicare, they accept your Medigap

- Medigap plans don’t cover: Vision or Dental Services, Eyeglasses, Hearing Aids

- More and more Medigap plans are coming with Vision, Dental, Eyeglass, and Hearing Aid Discounts

- Medicare Advantage plans often include limited coverage on these services included in their plan

- Note, certain medically necessary vision/dental services are covered by Medicare A, B and Medigap like cataract surgery, diabetic eye exams, glaucoma treatment, etc.

What are the Guaranteed Issue Times to Enroll in a Medigap?

- Guaranteed issue = cover all your pre-existing health conditions and cannot deny or charge you more for a Medigap policy due to past/present health issues

- Initial enrollment period

- Lasts 6 months & begins the first day of the month you’re both 65 or older AND enrolled in Medicare Part B

- Guaranteed Issue period with no medical underwriting

- Medicare Advantage Trial right periods

- Move out of service area

- You are losing employer (retiree/group/union) coverage

- See the 2023 Choosing a Medigap Policy book for other GI enrollment periods

What if I want to enroll in a Medigap at a Non-Guaranteed Issue Period?

- You will be subject to medical underwriting due to past and present medical conditions

- Can be denied coverage

- Can be subjected to higher premiums

To learn more, click the resources and references below or check out my YouTube video about Medigap plans! Stay safe & stay informed!

Resources & References

2023 Choosing a Medigap Policy

Let's talk

We would love to hear from you!